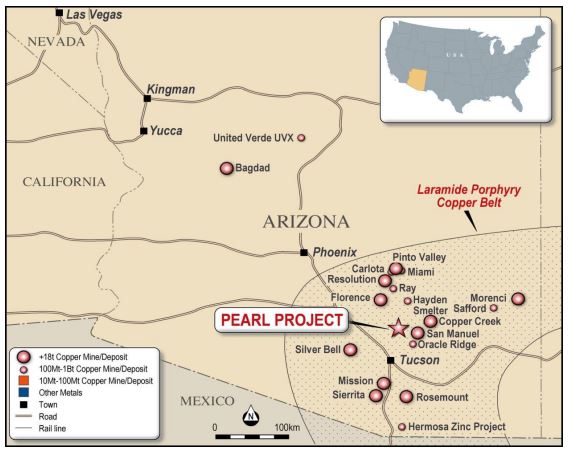

Golden Mile Resources Ltd (Golden Mile; ASX: G88) is a Western Australian based resource company with an advanced critical metals project and multi-element exploration projects located in the Tier 1 Mining Jurisdictions of Arizona, USA and Western Australia.

The Pearl Copper Project is situated in the San Manuel

mining district, Pinal County, Arizona, approximately 40km north-east of Tucson, near the town of Mammoth. Arizona is the USA’s top copper producing state. It has had minimal modern exploration yet

is situated immediately north of BHP’s San Manuel-Kalamazoo Mine, one of the largest deposits in the Laramide Porphyry Copper Province.

At the Quicksilver Nickel-Cobalt Project, located about 280km southeast of Perth, the Company has delineated an Indicated and Inferred Resource of 26.3 Mt @ 0.64% Ni & 0.04% Co (cut-off grade >0.5% Ni or >0.05% Co) and is advancing the critical metals project.

The ~816km2 Yarrambee Ni, Cu, Zn, PGE & Au Project is within the Narndee Igneous Complex, located in the Murchison region, WA.

The Company’s gold projects are in the highly prospective Eastern Goldfields region, which includes the Yuinmery (100%) and Leonora JV (Patronus Resources earning up to 80%) Projects.

To learn more about each Project please scroll down.

The Pearl Copper Project is situated in the San Manuel mining district, Pinal County, Arizona, approximately 40km north-east of Tucson, near the town of Mammoth. Arizona is a Tier 1 mining jurisdiction, and the USA’s top copper producing state. It has had minimal modern exploration yet is situated immediately north of BHP’s San Manuel-Kalamazoo Mine, one of the largest deposits in the Laramide Porphyry Copper Province.

Initial field reconnaissance has already identified two advanced targets. The fact that both the Odyssey and Ford Prospects remain undrilled, despite showing all the surface characteristics of major mineralised systems, presents Golden Mile with a fast-tracked opportunity to make a significant copper discovery. Located within the world-class Laramide Porphyry Copper Belt, which hosts numerous significant deposits and mines, the Pearl Project’s exploration potential is substantial.

Golden Mile secured the Pearl copper project in August 2024. The asset hosts more than 50 artisanal copper workings and shares similar geological characteristics to the San Manuel-Kalamazoo and Pinto Valley porphyry copper mines. The project exhibits widespread surface alteration highlighted by rock chip samples of 7.3% copper, 0.43% molybdenum, 19.9% lead, 4.9% zinc and 360 g/t silver.

The most significant working within the Project area are the Pearl and Ford Mines. The Pearl Mine is located on the north-western portion of the Project within the Odyssey Prospect. It produced up to 60,000 tons of ore containing copper oxide and sulphide, lead, silver and gold from largely artisanal workings from 1915 to 1941 (Force, 1997).

Historical records from the Ford Mine, located within the Pearl Copper Project mine claims have reported Lead assays from 5.7% to 31.3%, copper assays from 5.8% to 10.6% and that gold increases in the deeper levels from 0.01 oz to 0.54 oz (16.7g/t) (Baird, 1942).

Significant upside from organic exploration exists given Pearl’s geographic location, situated in the heart of the world-class Laramide Porphyry Copper Belt and 1 km of the San Manuel Mine (historic production of 4.7 Mt) that has been operating for 44 years.

Arizona represents approximately 70 percent of domestic US copper production. The Pearl project was historically mined from 1915 to 1941.

The Quicksilver Nickel Cobalt Project is located approximately 280km south east of Perth. The Project comprises ~50 km2 in an area with excellent local infrastructure, including easy access to grid power, sealed roads, and a railway line to key ports.

In 2018 the Company announced a maiden indicated and inferred Resource Estimate of 26.3 Mt @ 0.64% Ni & 0.04% Co (cut-off grade >0.5% Ni or >0.05% Co) for the Quicksilver deposit (refer to Golden Mile Resources ASX announcement dated 19 November 2018).

Metallurgical testwork significantly developed the understanding of the unique saprolitic mineralisation at the Project and a potential pathway to production (refer ASX Announcement dated 18 May 2022). The Company has identified a customised multi-products flowsheet to produce nickel-cobalt and iron-nickel-cobalt-chromium concentrates as well as industrial products (refer ASX Announcement 18 May 2022) . The process would be low energy using the physical attributes of the free digging ore.

Assay results also demonstrated significant REE mineralisation potential at Quicksilver (refer ASX announcements dated 6 December 2022 and 18 January 2023).

Golden Mile completed its Stage Three metallurgical investigation, confirming

the physical nickel upgrading potential of the Quicksilver mineralisation. This highlights the potential of the mica and cobalt rich domains within the Resource.

Highlights included:

• An initial process beneficiation flowsheet concept has been developed, which includes

crushing, scrubbing, screening, regrinding, magnetic and gravity separation processes.

• Stage 3 testwork has demonstrated potential for the flowsheet to target a 75% nickel

recovery within four concentrates including:

– A high-grade nickel in mica concentrate

– A low-silica, magnetic nickel concentrate

– A cobalt, nickel, and manganese gravity concentrate with nickel-cobalt ratios ranging

from 1.9 to 5.4, which is advantageous for downstream processing to an intermediate that could potentially be supply input to the pCAM market.

– Gold grades of 0.1 to 2.3 g/t in gravity concentrates –

– Potential for further enhancement of three of the four concentrates through

secondary processing options.

The Company believes that through innovation it can unlock significant value from the Quicksilver project

The Yuinmery Project is located 80km to the southwest of Sandstone in the Youanmi Gold Mining District, approximately 10km east of the Youanmi Gold Mine (ASX:RXL and VMC), and adjacent to the Yuinmery Cu-Au Project (ASX:ERL). It is composed of a single exploration licence (tenement E57/1043) that was acquired in late 2019.

The area is experiencing a significant upswing in activity thanks to the high-grade Penny North (ASX:RMS) and Grace (ASX:RXL) discoveries.

The region is traversed by the north to north-northeast trending Youanmi Shear Zone, a major crustal structure that marks the boundary between the Murchison and Southern Cross domains. Gold mineralisation in the region appears to be correlated with secondary northwest trending structures intersecting the main Youanmi Shear.

The Yuinmery Project area contains approximately 9km strike length of the Yuinmery Shear. This sheared granite-greenstone contact represents a favourable structural target for gold mineralisation.

First pass targeting by Golden Mile has defined several anomalies defined by ‘indicator’ minerals associated with mineralisation and hydrothermal alteration and detailed ground magnetics and soils have been collected by the Company over a section of these targets.

The Company defined a significant NNE trending gold-in-soil anomalies over 800m strike at Elephants Reef and Ladies Patch has (Refer G88 ASX announcement 12/11/20) which correlate with historic gold-in-soil & multi-element pathfinder assays.

Another soil sampling program identified several new targets including Grey Beard for gold and the Fitz Bore area shaping up as an exciting nickel-copper play. These newly identified targets are in addition to samples confirming the broad zone of gold anomalism at the Elephant Reef and Ladies Patch prospects which are adjacent to a major controlling structure in an exploration hot spot.

Further ground-based work is planned to advance exploration on these exciting targets at Yuinmery including infill soil sampling, aircore drilling traverses and deeper RC to follow up historical intersections.

While Golden Mile’s primary focus for the Yuinmery Project is gold, the Company notes the potential for the Yuinmery Greenstone Belt to host polymetallic VMS and Cu-Ni-PGM deposits such as Empire Resource’s (ASX:ERL) adjacent Yuinmery Cu-Au project (refer ERL ASX Announcement 23 July 2020).

The Yarrambee Project, comprises ~816km2 landholding covering the Narndee Igneous Complex (NIC) in the Murchison Region of Western Australia, making Golden Mile the largest landholder over the NIC. It is located about 500km northeast of Perth.

The NIC is considered highly prospective for Ni-Cu-PGE mineralisation (eg: Voisey’s Bay, Nova, Julimar), with the Company targeting the “feeder system” of the NIC (the ‘chonolith model’), with numerous mafic-ultramafic satellite intrusions to be investigated within the tenement package.

Yarrambee also contains portions of the surrounding Yaloginda Formation, a geological package highly prospective for VMS mineralisation. These include two high quality, advanced Cu-Zn VMS style prospects identified at Narndee and Yalanga Bore.

Golden Mile will drill test priority conductors identified from HEM and EM surveys, along with targets at the Narndee and Yalanga Bore Prospects.

Narndee (Copper-Zinc)

The work completed to date on Narndee has defined a footprint of a VMS system, which is open in all directions where no effective ground or downhole EM geophysical testing has been undertaken.

Drilling by previous explorers intersected several zones of massive and disseminated sulphide mineralisation including:

Yalanga Bore (Copper-Zinc)

Yalanga Bore is a historical VMS prospect with a skarn overprint around an outcropping gossan which has seen limited follow up exploration. Historical intersections at Yalanga Bore include:

Golden Mile’s Leonora JV Project is located approximately 40km north east of Leonora and 230km north of Kalgoorlie. It comprises a regionally significant tenement package focused on the Ironstone Well, Monarch and Benalla Gold Projects located east of the Leonora mining centre in the prolific Eastern Goldfields of Western Australia.

The Company’s projects are along strike from and surrounded by significant gold production, development and exploration projects including St Barbara’s Gwalia Project (ASX:SBM) and Patronus Resources’ Cardinia Project (ASX:PTN) (formerly Kin Mining NL) which hosts a resource of 945,000oz Au across a number of near-surface deposits.

In January 2022 Golden Mile finalised an Earn-in and Joint Venture agreement with Kin Mining Ltd (now Patronus Resources) over the Company’s Leonora Gold Project comprising the Benalla, Monarch and Ironstone Well project areas. Under the terms of the agreement, Patronus will have the right to earn an initial 60% interest in the Project and move to 80% ownership through a series of staged milestones. Patronus will employ its successful exploration techniques and detailed geological knowledge across this addition +120 square kms of contiguous tenure located adjacent to Patronus’s 1.28Moz Cardinia Gold Project.

The Gidgee Project is composed of two exploration licence applications covering 400 square kilometres adjacent to Horizon Gold’s Gidgee gold mine. The tenure takes in a number of potential target areas, including areas prospective for gold, nickel, cobalt, copper and iron ore.

The Company has a Farm-In Agreement granting Gateway Mining Limited (“Gateway”; ASX:GML) the right to acquire an 80% interest in the Gidgee Project. Gateway has pre-existing interests in tenements located within the historical gold mining areas in the Gum Creek (Gidgee) Goldfield.

Gidgee is prospective for both gold and base metal mineralisation and Golden Mile retains a 20% interest allowing shareholders to benefit from any exploration upside and success.

Sign up here to receive the latest news from Golden Mile Resources

Copyright © 2021. Golden Mile Resources Ltd. All rights reserved.

Website by Net Search.